THE BUDGET EMPHASIZES THE GOVERNMENT OF SAINT LUCIA'S COMMITTMENT TO RESPONSIBLE GOVERNANCE.

Prime Minister and Minister for Finance, Hon. Philip J. Pierre, on Tuesday, April 2022, delivered his 2025/2026 Budget Address, outlining several initiatives to improve the lives of Saint Lucians.

Prime Minister and Minister for Finance, Hon. Philip J. Pierre, on Tuesday, April 2022, delivered his 2025/2026 Budget Address, outlining several initiatives to improve the lives of Saint Lucians.

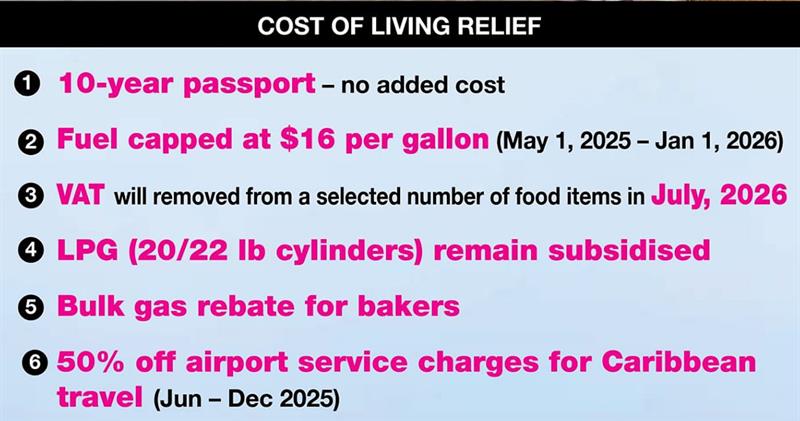

Key highlights from the Budget are as follows:

- There will be No new taxes.

- Temporary teachers will now receive full salaries for the month of August.

- $250,000 will be allocated to the Ministry of Education for schools to assist students facing challenges with accessing feminine hygiene products.

- Nursing students at SALCC will receive increased tuition support: $2,500 in Year 1, $2,500 in Year 2, $5,000 in Year 3, $10,000 in final year — full tuition paid.

- The tuition subsidy for students enrolled at privately owned preschools will increase from $50 to $100.

- Subvention to privately owned preschools will be increased from $2,500 to $3,000 per child.

- The government will now pay for two more CXC subjects, bringing the total to four CXC subjects. Students who have been out of school for up to one year will be eligible.

- The Tax Amnesty Program will be extended until May 1, 2026.

- Over 1,900 non-established government workers will become permanent after two years of service.

- Effective 1st January 2025, pension income will be tax-free.

- A one-time payment of $600 will be made to pensioners in November 2025.

- From July 1, 2025, NIC pensions will be increased based on the cost of living index. (Consumer Price Index).

- Police, firemen, and correctional officers who are NIC contributors and have served at least 20 years and are aged 55 or older will now be entitled to an NIC pension.

- Airport service charges for regional travel will be cut by 50% from June to December 2025.

- Income tax deductible allowances will be increased from $30,000 to $40,000 for the calendar year 2025.

- VAT will be removed from a selected number of food items in July 2026

- Businesses investing in cybersecurity, AI tools, or ICT staff training can now claim up to $50,000 as a tax-deductible expense.

The Prime Minister’s 2025/2026 Budget Address emphasizes the Government of Saint Lucia’s commitment to responsible governance and people-focused policies. Citizens from all sectors of society are expected to benefit from these new initiatives. The government’s policies continue to be tailored to improve the well-being of Saint Lucians.